Nassau County Real Estate Transfer Tax . the new law levies an additional tax of $1.25 for each $500 (or portion thereof) of consideration on transfers of (i) residential. real estate transfer tax. use our real estate transfer tax calculator to find out how much your real estate transfer tax would cost. Property sales and transfer information. the land records viewer allows access to almost all information maintained by the department of assessment including. New york state imposes a real estate transfer tax on conveyances of real property or interests. The amount and who’s responsible. learn about assessments and property taxes; Transfer tax rates by state New york state imposes a real estate transfer tax, for which the seller (or “grantor”) is generally. nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité. whenever you buy or sell property in the state of new york, you could be subject to certain transfer taxes. real estate transfer tax.

from www.formsbank.com

learn about assessments and property taxes; New york state imposes a real estate transfer tax on conveyances of real property or interests. real estate transfer tax. the new law levies an additional tax of $1.25 for each $500 (or portion thereof) of consideration on transfers of (i) residential. whenever you buy or sell property in the state of new york, you could be subject to certain transfer taxes. New york state imposes a real estate transfer tax, for which the seller (or “grantor”) is generally. real estate transfer tax. The amount and who’s responsible. Transfer tax rates by state use our real estate transfer tax calculator to find out how much your real estate transfer tax would cost.

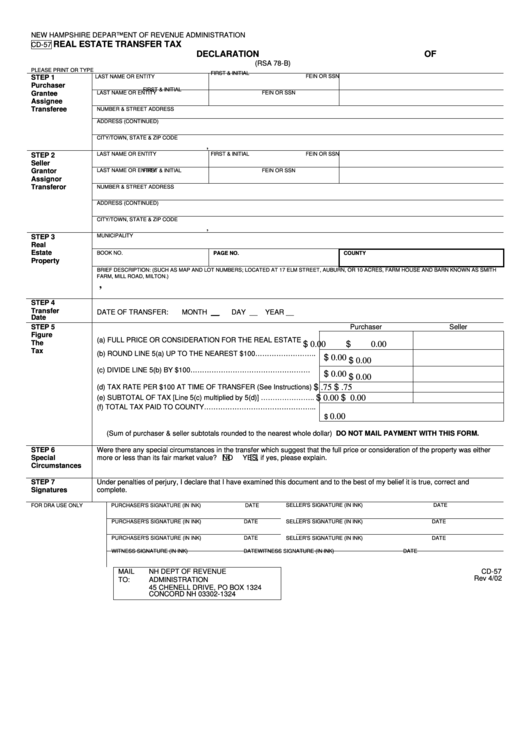

Form Rsa 78B Real Estate Transfer Tax Declaration Of Consideration

Nassau County Real Estate Transfer Tax whenever you buy or sell property in the state of new york, you could be subject to certain transfer taxes. whenever you buy or sell property in the state of new york, you could be subject to certain transfer taxes. The amount and who’s responsible. Transfer tax rates by state the land records viewer allows access to almost all information maintained by the department of assessment including. use our real estate transfer tax calculator to find out how much your real estate transfer tax would cost. New york state imposes a real estate transfer tax on conveyances of real property or interests. real estate transfer tax. the new law levies an additional tax of $1.25 for each $500 (or portion thereof) of consideration on transfers of (i) residential. real estate transfer tax. Property sales and transfer information. learn about assessments and property taxes; New york state imposes a real estate transfer tax, for which the seller (or “grantor”) is generally. nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité.

From www.pinterest.com

Map Nassau County Long Island Real Estate Median Home Prices Nassau Nassau County Real Estate Transfer Tax the new law levies an additional tax of $1.25 for each $500 (or portion thereof) of consideration on transfers of (i) residential. real estate transfer tax. the land records viewer allows access to almost all information maintained by the department of assessment including. nous voudrions effectuer une description ici mais le site que vous consultez ne. Nassau County Real Estate Transfer Tax.

From asrlawfirm.com

Real Property Transfer Taxes in Florida ASR Law Firm Nassau County Real Estate Transfer Tax Transfer tax rates by state use our real estate transfer tax calculator to find out how much your real estate transfer tax would cost. New york state imposes a real estate transfer tax on conveyances of real property or interests. New york state imposes a real estate transfer tax, for which the seller (or “grantor”) is generally. The amount. Nassau County Real Estate Transfer Tax.

From mayraroden.blogspot.com

Mayra Roden Nassau County Real Estate Transfer Tax nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité. the land records viewer allows access to almost all information maintained by the department of assessment including. New york state imposes a real estate transfer tax, for which the seller (or “grantor”) is generally. real estate transfer tax.. Nassau County Real Estate Transfer Tax.

From www.theoldfathergroup.com

Real Estate Transfer Tax What Are They & Where Does The Money Go Nassau County Real Estate Transfer Tax The amount and who’s responsible. real estate transfer tax. New york state imposes a real estate transfer tax on conveyances of real property or interests. learn about assessments and property taxes; New york state imposes a real estate transfer tax, for which the seller (or “grantor”) is generally. the new law levies an additional tax of $1.25. Nassau County Real Estate Transfer Tax.

From www.formsbank.com

Form Rsa 78B Real Estate Transfer Tax Declaration Of Consideration Nassau County Real Estate Transfer Tax nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité. whenever you buy or sell property in the state of new york, you could be subject to certain transfer taxes. learn about assessments and property taxes; the new law levies an additional tax of $1.25 for each. Nassau County Real Estate Transfer Tax.

From help.ltsa.ca

File a Property Transfer Tax Return LTSA Help Nassau County Real Estate Transfer Tax Property sales and transfer information. New york state imposes a real estate transfer tax on conveyances of real property or interests. the new law levies an additional tax of $1.25 for each $500 (or portion thereof) of consideration on transfers of (i) residential. real estate transfer tax. real estate transfer tax. use our real estate transfer. Nassau County Real Estate Transfer Tax.

From www.hauseit.com

How Much Are Real Estate Transfer Taxes in Los Angeles? Nassau County Real Estate Transfer Tax the new law levies an additional tax of $1.25 for each $500 (or portion thereof) of consideration on transfers of (i) residential. New york state imposes a real estate transfer tax, for which the seller (or “grantor”) is generally. New york state imposes a real estate transfer tax on conveyances of real property or interests. learn about assessments. Nassau County Real Estate Transfer Tax.

From www.formsbank.com

Form 2719 Return For Real Estate Transfer Tax printable pdf download Nassau County Real Estate Transfer Tax learn about assessments and property taxes; the new law levies an additional tax of $1.25 for each $500 (or portion thereof) of consideration on transfers of (i) residential. use our real estate transfer tax calculator to find out how much your real estate transfer tax would cost. Property sales and transfer information. Transfer tax rates by state. Nassau County Real Estate Transfer Tax.

From www.educatorsrealty.com

October 2023 Nassau County Real Estate Market Report Nassau County Real Estate Transfer Tax real estate transfer tax. real estate transfer tax. The amount and who’s responsible. learn about assessments and property taxes; New york state imposes a real estate transfer tax on conveyances of real property or interests. use our real estate transfer tax calculator to find out how much your real estate transfer tax would cost. nous. Nassau County Real Estate Transfer Tax.

From www.pdffiller.com

County Nassau Transfer Tax Fill Online, Printable, Fillable, Blank Nassau County Real Estate Transfer Tax nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité. whenever you buy or sell property in the state of new york, you could be subject to certain transfer taxes. New york state imposes a real estate transfer tax on conveyances of real property or interests. The amount and. Nassau County Real Estate Transfer Tax.

From www.youtube.com

How to Easily Calculate Property Transfer Tax YouTube Nassau County Real Estate Transfer Tax real estate transfer tax. Transfer tax rates by state use our real estate transfer tax calculator to find out how much your real estate transfer tax would cost. the land records viewer allows access to almost all information maintained by the department of assessment including. The amount and who’s responsible. learn about assessments and property taxes;. Nassau County Real Estate Transfer Tax.

From marinrinaldi.blogspot.com

nassau county property tax rate 2021 Marin Rinaldi Nassau County Real Estate Transfer Tax learn about assessments and property taxes; Property sales and transfer information. real estate transfer tax. Transfer tax rates by state New york state imposes a real estate transfer tax on conveyances of real property or interests. whenever you buy or sell property in the state of new york, you could be subject to certain transfer taxes. The. Nassau County Real Estate Transfer Tax.

From cedgebso.blob.core.windows.net

Connecticut Real Estate Transfer Tax Calculator at Edward Parsons blog Nassau County Real Estate Transfer Tax Property sales and transfer information. New york state imposes a real estate transfer tax on conveyances of real property or interests. The amount and who’s responsible. New york state imposes a real estate transfer tax, for which the seller (or “grantor”) is generally. use our real estate transfer tax calculator to find out how much your real estate transfer. Nassau County Real Estate Transfer Tax.

From www.formsbank.com

County Of Nassau Real Estate Transfer Tax Return printable pdf download Nassau County Real Estate Transfer Tax the new law levies an additional tax of $1.25 for each $500 (or portion thereof) of consideration on transfers of (i) residential. New york state imposes a real estate transfer tax, for which the seller (or “grantor”) is generally. real estate transfer tax. nous voudrions effectuer une description ici mais le site que vous consultez ne nous. Nassau County Real Estate Transfer Tax.

From www.youtube.com

What is real estate transfer tax? YouTube Nassau County Real Estate Transfer Tax nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité. use our real estate transfer tax calculator to find out how much your real estate transfer tax would cost. Transfer tax rates by state the land records viewer allows access to almost all information maintained by the department. Nassau County Real Estate Transfer Tax.

From silverlaw.ca

What do I need to know about Property Transfer Tax? Silver Law Nassau County Real Estate Transfer Tax use our real estate transfer tax calculator to find out how much your real estate transfer tax would cost. the new law levies an additional tax of $1.25 for each $500 (or portion thereof) of consideration on transfers of (i) residential. whenever you buy or sell property in the state of new york, you could be subject. Nassau County Real Estate Transfer Tax.

From www.tax.ny.gov

Property tax bill examples Nassau County Real Estate Transfer Tax the land records viewer allows access to almost all information maintained by the department of assessment including. real estate transfer tax. New york state imposes a real estate transfer tax, for which the seller (or “grantor”) is generally. New york state imposes a real estate transfer tax on conveyances of real property or interests. Transfer tax rates by. Nassau County Real Estate Transfer Tax.

From formspal.com

Real Estate Transfer Declaration PDF Form FormsPal Nassau County Real Estate Transfer Tax nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité. learn about assessments and property taxes; Property sales and transfer information. the new law levies an additional tax of $1.25 for each $500 (or portion thereof) of consideration on transfers of (i) residential. real estate transfer tax.. Nassau County Real Estate Transfer Tax.